Through our ongoing “Rents Uncovered” series we aim to bring the same level of transparency to Poland’s leasing market as is seen in the other 18 countries around the world in which Prologis does business. Started in 2016, in “Rents Uncovered”, we publish the actual rent levels that we have achieved in Poland in recent months, with complete openness and transparency. We do this to sustain a continued focus on transparency and awareness, for the benefit of everyone who operates in the logistics real estate market.

Where we stand

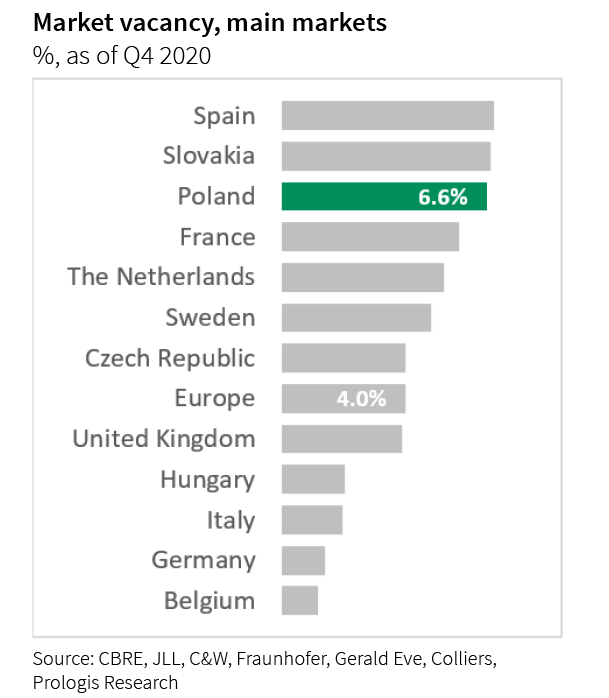

Market statistics show that 2020 was another huge year for Polish logistics real estate. It was the fourth consecutive year in which there was both net absorption and new build in excess of two million square meters. However, market vacancy is one of the highest and rental rates remain the lowest in Europe. Prime net effective market rents are on average below €30 per sqm/year in the main markets, while for the rest of the continent the average is €57 per sqm/year

Notably we observe the widest spread between base and effective rents in any of the markets in which we operate. Largely, this is linked to deal set up and structure of the lease contract. Poland is the only country in Europe where side letters to lease contracts are still widely used. These are additional agreements under which customers receive financial incentives that are not disclosed under the lease agreement. Unsurprisingly, the use of side letters leads to uncertainty in the calculation of effective rent for customers, landlords and investors. We continue to question why side letters do not form part of the lease agreement and why they are usually “confidential” in nature. Undisclosed financial incentives lead to a risk of artificially inflated nominal rents and project valuations.

Risk and VAT

The practice of concealing rent incentives in side letters is not only questionable from an ethical and fair competition standpoint, it is also a source of potential risk for both the tenant receiving the incentive and for investors buying completed buildings.

Risks related to VAT tax recovery:

- Cash incentives are usually classed as taxable sales by the tenant. Nevertheless, VAT recovery might not be a straightforward matter. Difficulty may be encountered evidencing to the tax authorities that the tenant has provided a significant service to their landlords since the tenant’s activity is very often limited to only extending or concluding lease agreements. It can be argued by the tax authorities that the cash incentive is in fact rebate-decreasing, which cannot be treated as supply of services. VAT accountability difficulties may therefore be experienced by both the landlord and the tenant. These difficulties can easily be inherited by an investor purchasing a project through a share transaction.

Risks related to asset sale transactions:

- Under Article 678 of the Polish Civil Code the purchaser of a property automatically becomes the landlord under a lease agreement but landlord obligations in side letters do not transfer automatically. If the cash incentive to tenants is staggered over several payments and the project is sold to a new investor, it creates a significant risk for tenants.

For the Polish logistics real estate market to continue to develop dynamically, business ethics and fair competition standards should uniformly be adopted. Every market participant has a responsibility to mitigate risk and pay attention to non-transparent contractual practices.

The position of valuers also deserves special scrutiny. Valuers are well aware that side letters are commonplace in the market and are potentially opening themselves to reputational and financial risk and claims for negligence if they do not act in good faith and insist on full and complete disclosure of all financial incentives before providing a valuation.

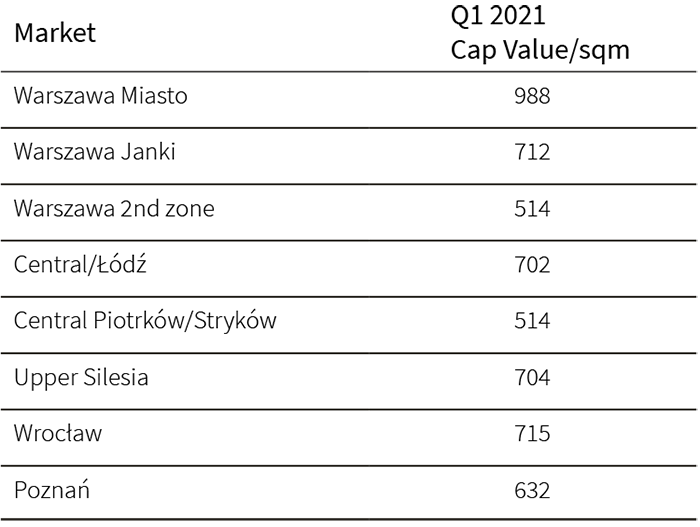

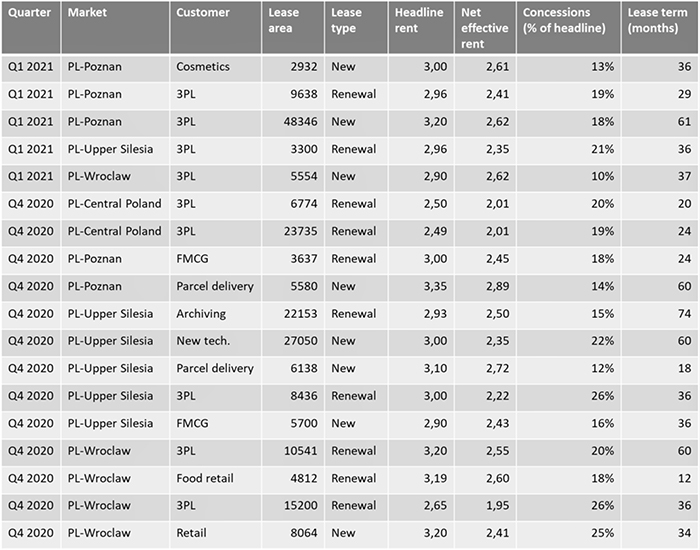

Prologis manages one of the leading logistics real estate portfolios in Poland and the rents we achieve on our properties fully reflect current market conditions. Below we share with you the details of our Q1 valuations and a list of lease transactions executed in the last 6 months.