In our third installment of our series on COVID-19 and its implications for logistics real estate, we identify concrete learnings from our operations in China and our proprietary data globally.

In China, activity is picking up across our business and amongst our customers, and signs are emerging of an economic recovery as many return to work. In the U.S., Prologis’ proprietary Industrial Business Indicator™ (IBI), which tracks customer activity in the U.S., indicates a slowdown, albeit not as deep as during the Global Financial Crisis. In our previous COVID-19 updates (March 12, March 19), we identified potential factors that could help temper the downturn for logistics real estate. This week, our survey reveals that utilization rates remain elevated in mid-84% range, modestly below the 85-87% range of the last four years. This new data point indicates facilities’ continuing limited capacity to flex in order to accommodate growth where needed.

As China begins to emerge from the outbreak, our research identifies four key metrics that could apply to both the U.S. and Europe in the coming months:

- Continued operations. Throughout the outbreak, logistics operations continued except where strict government lockdowns were mandated. For those that remained open, Prologis customers took a raft of measures to ensure safety within the facilities and undertook remedial efforts where needed. Delays in logistics real estate construction were more widespread and restarting projects has taken longer.

- A reacceleration for e-commerce. Activity was most resilient among customers focused on end consumption and city distribution, especially for e-commerce customers. Overall, deliveries continued without major disruption even in the face of labor shortages. By contrast, automotive has been less active. As in the U.S. and Europe, multiple online segments performed well, led by grocery and general retailers.

- Leases signed. Despite lockdowns and travel restrictions that limited showings during the worst point of the outbreak, activity continued (albeit at a slower pace). In February and March, Prologis signed more than a half dozen new and renewal leases in China amounting to roughly 600,000 square feet.

- Economic recovery. A sharp correction occurred in January and February. While early, an economic recovery is beginning to emerge in China as factories reopen and city life normalizes (although with prudent precautionary measures for safety). At the same time, the market remains vigilant on a second COVID-19 wave, and economic volatility still could depress logistics real estate demand in the near term.

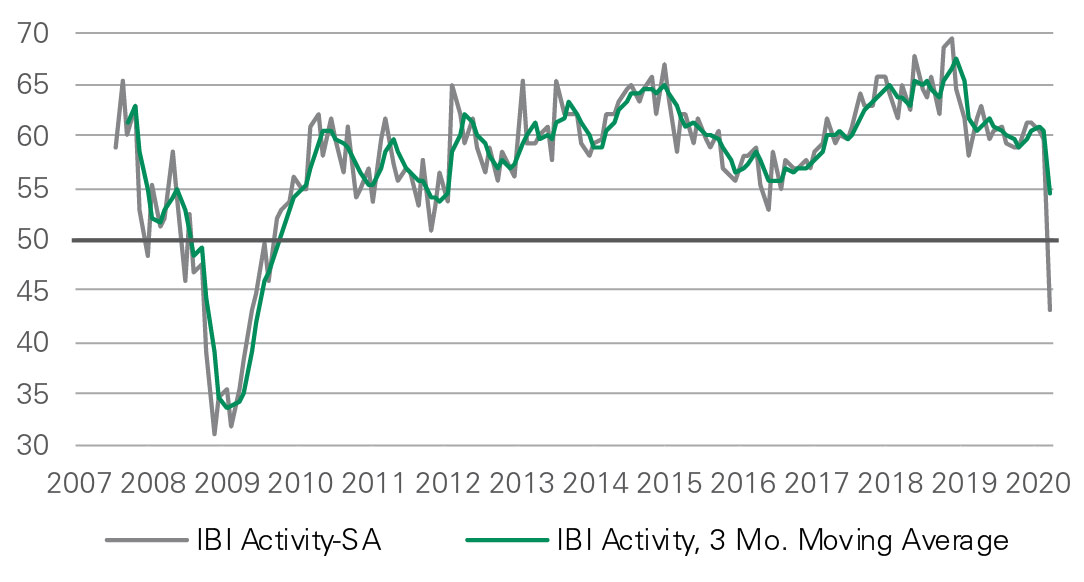

Logistics real estate in the U.S. and Europe is likely to experience a softening in activity. Consistent with the pattern in China, economic metrics in the U.S. and Europe are showing a sharp deceleration in activity. Notably in the U.S., initial unemployment claims reached their highest-ever levels and U.S. and Europe services PMIs fell to all-time lows. Our IBI also declined in March, falling to 41.7 from 60.0. Current levels are above the lows reached during the Global Financial Crisis, when the index fell to 31.1 in November 2008. Such volatility signals a recession and that logistics demand could pause or reverse in 2H’20, if not sooner, posing a risk to market vacancy rates and rent growth. One other difference from the Global Financial Crisis is ultra-low vacancies in this cycle going into a period of uncertainty. Today, vacancies are 4.6% in the U.S. and below 4% in Europe, substantially below the mid-7%s that prevailed in 2007/2008.

This month we supplemented our survey with a specific focus on the impact of COVID-19 on operations. This data reveals that a small minority (22%) report a sharp decline in activity levels due to (a) no product to distribute or (b) closures for safety purposes—both of which are likely to be transitory. By contrast, a large minority (38%) report either no change or an increase in activity. The remaining respondents report a moderate slowdown and are taking precautionary measures.

Background on the Industrial Business Indicator™

This proprietary monthly survey of our U.S. customers was introduced in 2007. We collate activity levels and use that data to estimate industry utilization (out of 100%). The activity index is our headline figure. As a diffusion index, it is benchmarked to 50, to which we add the percentage of customers who report more activity and subtract the percentage of customers who report less activity.

Exhibit 1

IBI ACTIVITY INDEX

Index, 50 = neutral, seasonally adjusted

Source: Prologis Research

As we noted in last week’s update, the new structural growth drivers of higher inventory levels and a reacceleration of e-commerce may combine with four factors to temper the downturn for logistics:

- strong momentum and ultra-low market vacancies;

- diverse demand and growth among certain categories due to COVID-19, including e-commerce, groceries and home improvement despite weakness in other categories such as auto;

- inventory restocking flowing from China; and

- slowed development starts.

This week, our data indicates that facilities continue to operate with limited capacity to flex in order to accommodate growth where needed. Utilization rates remain at a still-elevated 84.5%. We expect that the short term will be dominated by depressed economic activity and limited capital availability, especially for small- and medium-sized businesses. Fiscal stimulus will help. Logistics real estate demand, occupancies and rent growth all face headwinds.

Logistics is well-positioned for the long term. Looking across all real estate property types, performance will follow on how customers/users adapt in this environment—for example, office users and their adoption of telecommuting versus coworking. For logistics real estate, momentum continues to build for new structural drivers to play a role in the medium and long term, namely (i) higher inventory levels for business continuity purposes and (ii) a reacceleration of e-commerce from growth in both new consumer categories (seniors) and product categories (groceries).

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of December 31, 2019, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 964 million square feet (89 million square meters) in 19 countries.

Prologis leases modern logistics facilities to a diverse base of approximately 5,500 customers across two major categories: business-to-business and retail/online fulfillment.